[ad_1]

Shares fell all over the world, whereas bonds climbed with gold on concern the Israel-Hamas struggle will escalate right into a wider battle within the Center East. Oil pulled again after hitting $90 a barrel.

The S&P 500 dropped over 1%, notching its worst week in a month. The gauge breached its 200-day shifting common — seen by some chartists as a bearish sign. Wall Avenue’s “worry gauge” — the VIX — rose to the best since March.

Megacaps bought off, with Tesla Inc. posting its greatest weekly slide since December. American Categorical Co. tumbled amid disappointing volumes on its playing cards. Areas Monetary Corp. sank after warning of additional declines in web curiosity revenue.

Merchants continued to hunt haven amid the newest geopolitical developments. Treasury yields pared weekly will increase that pushed the 10-year fee to virtually 5%. Gold edged nearer to $2,000 an oz.

“The continued scenario within the Center East has triggered a surge of volatility within the oil and inventory markets, compelling traders to re-evaluate their methods and shift their focus from riskier property to ‘safer’ investments,” mentioned Fawad Razaqzada, market analyst at Metropolis Index and Foreign exchange.com.

Hamas launched two Americans who had been held captive in Gaza. Leaders from across the area are heading to Cairo for a Saturday summit on the disaster. Israel’s army mentioned it struck Hamas targets in Gaza in a single day.

Israel additionally responded to fireside from Lebanon by hitting Hezbollah property, and evacuated residents close to the border. The Iran-backed militant group mentioned it fired guided missiles at a number of Israeli websites.

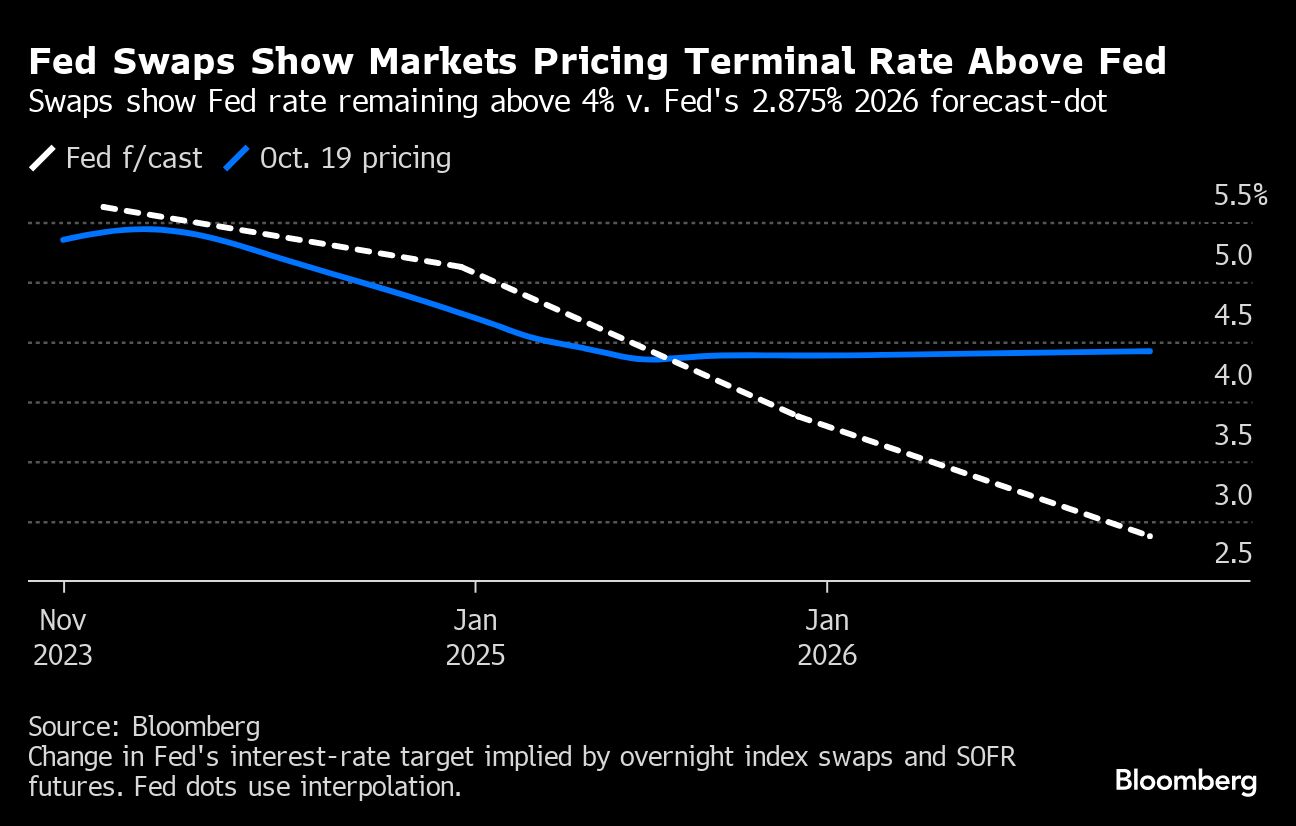

Apart from the Center East disaster, international markets have been whipped round in latest weeks by climbing Treasury yields and rising worries about rates of interest staying elevated for longer.

Federal Reserve Financial institution of Cleveland President Loretta Mester mentioned the US central financial institution is near wrapping up its tightening marketing campaign if the economic system evolves as anticipated.

Company Earnings

Merchants additionally waded by a raft company earnings. Of the 86 corporations in S&P 500 which have introduced outcomes by Friday morning, 74% beat analysts’ revenue estimates, in contrast with 78% for the entire season a 12 months in the past, in keeping with knowledge compiled by Bloomberg.

Particular person shares reacted to earnings bulletins within the week or so since Company America began reporting outcomes.

However battle within the Center East and elevated Treasury yields have taken priority, inflicting S&P 500 constituents to more and more transfer in unison as international occasions sway markets broadly.

In half the buying and selling classes since Oct. 13, when the reporting cycle kicked off, at the very least 400 members within the S&P 500 have moved in the identical path. It’s a frequency that didn’t seem as soon as in comparable weeks the previous three earnings durations.

[ad_2]