[ad_1]

For elements of three a long time, certainly one of TV’s hottest exhibits has been “Whose Line is it Anyway?”, the spinoff of a UK improv present that used a rotating solid of actors, plus a musician and a slew of improv video games to get audiences laughing. One in all Whose Line’s extra widespread video games is named “Stand, Sit, Lie.” Actors are given a scene that they should act out, however in the course of the scene, one actor have to be sitting, one have to be standing, and one have to be mendacity down. If an actor adjustments place, the opposite actors should transfer rapidly to fill the empty area. If the standing actor sits down, the sitting actor has to face up. If the one sitting lies down…you get the image. Roles and positions change often.

SMB firms and Group & Voluntary Advantages insurers, brokers, and brokers are additionally shifting roles, seemingly at random. Roles will not be solely in flux, however they’re additionally virtually improvisational. SMB firms that used to lie down and look forward to brokers to feed them advantages are actually sitting up and trying to find their very own via completely different distribution channels. Insurers are increasing from brokers or brokers are actually standing up with new services and products and in search of further associate and channel choices.

Knowledge’s position can be in movement. For years, Group & Voluntary insurers have used comparatively little “suggestions” knowledge to tailor insurance coverage or companies. There was little or no plan customization. There was virtually no worker personalization for many advantages. In lots of circumstances, worker knowledge was held merely as a reputation in a bunch file. Insurers relied upon year-over-year claims expertise and utilization knowledge to adapt pricing. In the present day, nonetheless, workers and companies are keen to share extra related knowledge, however Group & Voluntary insurers are struggling to determine how one can put it to good use.

What insurers really want is a holistic have a look at:

a.) giving workers experiences they don’t wish to surrender once they depart the corporate,

b.) bettering their relationships and connections with value-added companies, and

c.) how their applied sciences develop employer curiosity and broaden product and channel choices.

Position-reversals and adjustments shall be wanted, however in an effort to add roles and stay productive, insurers might want to perceive how they’ll use expertise to construct their companies. It’ll require new makes use of of information, value-added companies, and channel choices.

To present everybody concerned higher insights into the Group & Voluntary market and alternatives, Majesco SMB survey knowledge and Insurer survey knowledge from our 2023 studies was used to match and distinction the place every participant thinks they’re, versus the place every participant is planning on going. Do these shifts match demand or will overlapping roles diminish everybody’s ROI? For an in-depth have a look at the outcomes, you may obtain, Bridging the Buyer Expectation Hole for Group and Voluntary Advantages.

The Significance of Knowledge & Analytics for Group & Voluntary Advantages

The significance of capturing, enriching, and utilizing knowledge for figuring out alternatives after which delivering a related and fascinating expertise for workers is essential for Group and Voluntary advantages suppliers in right this moment’s digital period. Whether or not the information is structured, unstructured, real-time IoT, or machine-generated, it have to be leveraged by superior analytics to allow the creation of tailor-made propositions and extra compelling buyer experiences…aligning worker must the suitable services and products, thereby creating deeper belief, loyalty, and engagement.

There is a chance throughout enrollment to supply steerage on merchandise primarily based on their knowledge. Shifting past the once-a-year enrollment can be a possibility to broaden merchandise and worth. Simply think about, the delivery of a kid, coming into faculty, buy of a brand new dwelling, getting a brand new pet, switching to a Gig employee standing, or retirement are all occasions or situations the place the worker’s threat wants change however could also be missed alternatives for insurers. Does this should be the case – particularly with the demand for particular person and Gig merchandise rising? Might we seize extra employee-related knowledge internally and externally to information them in deciding on insurance coverage advantages when wanted, not simply yearly? Sure, if we rethink how we do enterprise. Something that helps the worker make the suitable decisions on the proper instances creates buyer loyalty and worth.

SMB Buyer – Insurer Gaps for Knowledge Sources and Applied sciences

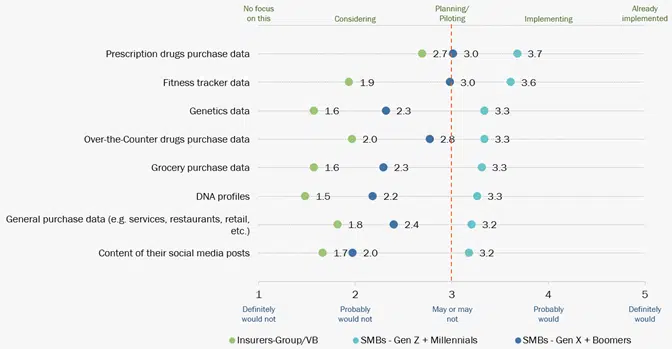

Structured, unstructured, transactional, real-time, and third-party knowledge throughout the Group and Voluntary advantages spectrum can be utilized to drive revolutionary data-led propositions, improved underwriting and claims, and finally enhanced buyer experiences. SMB prospects and their workers, notably Millennials and Gen Z are greater than keen to supply a broader vary of information for personalization, as represented in Determine 1. Nonetheless, insurers will not be utilizing this knowledge successfully, creating a big buyer expectation hole.

As extra workers search for entry to worksites or particular person merchandise which are simply transportable, having them priced primarily based on their private threat reasonably than as a part of the group shall be more and more demanded. As well as, use of the information and different demographic elements can be utilized to counsel particular merchandise throughout the profit plan which are extra aligned with their wants and expectations at enrollment, driving higher product adoption. That is one thing Majesco Clever Core for L&AH and Clever Gross sales and Underwriting Workbench do for our prospects. It’s why we name them “clever options.”

Determine 1: SMB-Insurer gaps in new knowledge sources and applied sciences for group/voluntary advantages pricing and underwriting

Main Insurers Navigating the Gaps Utilizing New Strategies or Knowledge Sources

Listed below are some examples of insurance coverage improv in motion. All three of those insurers reached outdoors of their conventional roles to supply a profit or service linked to traits or improvements from outdoors the business.

- Aflac launched dental, imaginative and prescient, and listening to plans for people pursuing contract, Gig, or solo entrepreneurial work outdoors conventional workplaces or coming into retirement.[1]

- A number one advantages supplier launched a brand new essential sickness product that gives DNA testing to help personalised most cancers therapies.

- Beam Insurance coverage launched a brand new dental product that features a sensible toothbrush to observe brushing for improved well being.[2]

Worth-Added Companies for Group & Voluntary Advantages

A key technique for insurers to deal with buyer expectations is to extend the worth of the merchandise they provide. To take action, insurers ought to bundle, or supply for a value, value-added companies that stretch the worth of the chance product/coverage, equivalent to incomes factors for wellness that can be utilized to purchase issues, annual monetary planning evaluation, roadside help, claims help and extra.

Worth-added companies can create new income alternatives whereas additionally strengthening the client relationship, loyalty, belief, and worth. Usually, these match into the position of economic wellness. It’s the place our partnership with Empathy to reinforce the claims course of provides large worth.

SMB Buyer – Insurer Gaps for Worth-Added Companies

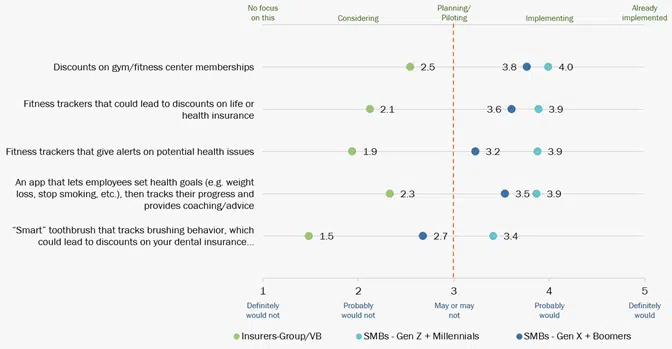

Throughout the board, there’s a important buyer expectation hole between what prospects need – no matter generational group – and what insurers are delivering, as represented in Determine 2. These value-added companies present tangible worth and improve general wellness with alerts and extra.

As well as, these choices might collect extra personalised knowledge to reinforce their pricing in addition to their general expertise. Many are “low hanging fruit” that may not take a variety of effort, however create large worth and begin insurers down the street to a extra holistic, valued providing and expertise for patrons. A lot of the worker well being and wellness knowledge wanted for value-added companies or data-supplemented merchandise is already out there right this moment via sources equivalent to Fitbit, Apple, and Strava APIs — insurers can merely make the most of out there knowledge. Employers and workers are rising way more amenable to sharing once they see the worth in offering it.

Determine 2: SMB-Insurer gaps in value-added companies for group/voluntary advantages

Main Insurers Navigating the Gaps with Worth-Added Companies

Listed below are some examples of firms which are making it occur. They’re bettering their merchandise as they encourage way of life and wellness enhancements amongst worker populations.

- EquiTrust Life Insurance coverage Firm partnered with Assured Allies to supply its Bridge fastened listed annuity with a long-term care rider policyholders entry to Assured Allies’ NeverStop knowledge and analytics-based wellness program.[3]

- YuLife within the UK wraps their group safety proposition with their worker well-being app, offering entry to well-being monitoring and counseling companies, and reward companions to construct a extra participating proposition for the worker whereas additionally offering companies to the employer to extend workers’ productiveness and loyalty.[4]

- Vitality presents a spread of value-added companies which are centered on wellness and are partnering with completely different insurers globally like John Hancock.

Distribution Channels for Group & Voluntary Advantages

Within the conventional distribution mannequin, insurers battle for a share of thoughts and pockets, so prospects consider them once they want insurance coverage. Many giant insurers spend lots of of tens of millions of {dollars} on promoting and others spend important {dollars} within the conventional agent/dealer channel, to maintain them “prime of thoughts” when insurance coverage is required. With the growing aggressive challenges to draw and retain prospects, insurers should develop and make the most of a broader distribution ecosystem that engages prospects when and the way they need…placing the client first.

In the present day’s interconnected world requires insurance coverage to play throughout a broad distribution spectrum of channel choices, increasing attain to prospects when, the place, and with whom they wish to purchase insurance coverage. These choices kind a distribution ecosystem that expands attain however requires a partnership strategy, notably for embedded channels.

SMB Buyer – Insurer Gaps within the Pursuit of Distribution Channels

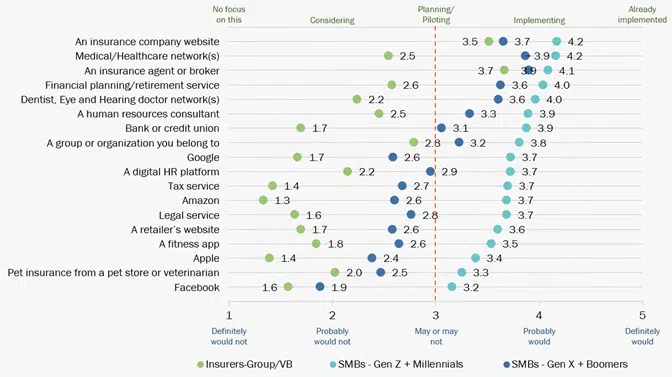

In the present day’s patrons nonetheless look to brokers and brokers, however will look to purchase insurance coverage via different channels or entities as nicely, as mirrored in Determine 3. SMBs are leveraging different trusted and dependable relationships that make shopping for insurance coverage via them related, notably for the Millennial and Gen Z SMB house owners.

This buyer expectation hole displays how group and voluntary profit insurers are limiting their market attain to this very giant and under-supported market section.

Determine 3: SMB-Insurer gaps in distribution channels for group/voluntary advantages

Main Firms Coming into the Trade by Taking up New Roles

- Highlighting the GAFA firm choices, some analysts are predicting Apple will enter the medical health insurance market in 2024, leveraging wealthy health and well being knowledge gathered from tens of millions of Apple Watch customers[5] which can straight align with their need for personalised insurance coverage utilizing knowledge from health trackers as famous beforehand.

- ADP works with some insurers to supply profit plan choices to SMBs, given they’ve a broader trusted relationship to handle HR and payroll wants.[6]

The Payoff — Taking up New Roles

As an alternative of continuous the decades-long battle for a share of the identical giant employer market, we now have an unmet market alternative with small and medium employers. The expansion alternatives are fairly astounding. Over 50% of workers work in an SMB firm. We have to take a step again to rethink how that market must be served, and the way we will present advantages to a vastly modified worker work setting and market.

There’s an unlimited space of untapped alternatives in diversified performs past the normal coverages provided. Whereas the anchor propositions for employer plans are healthcare and retirement companies and conventional group covers for defense and incapacity, increasing past this ordinary set is essential to shut the client expectation hole and drive progress.

Most of those payoffs shall be discovered underneath classes of new services and products (using knowledge in new methods), new relationships (utilizing untapped partnerships and channels), and further capabilities (offering employers with instruments that save effort and time, together with giving higher insights.) Every of those areas must be approached holistically utilizing a recent strategy to operations plus a tech transformation that features the usage of AI, machine studying, and clever core system design.

Majesco provides Group & Voluntary insurers a lift into new markets and channels by offering them with applied sciences that expertly match the calls for of the brand new, improvisational market panorama. To study extra about how Majesco helps construct a brand new framework for Group & Voluntary progress, go to Majesco’s Clever Core for L&AH, Clever Gross sales & Underwriting Workbench, Digital Enroll360 for L&AH, and Majesco ClaimVantage Enterprise Claims Administration for L&AH. Be sure you additionally obtain Bridging the Buyer Expectation Hole for Group and Voluntary Advantages.

[1] “Aflac Dental, Imaginative and prescient and Listening to Plans Now Accessible to People Exterior the Conventional Worksite,” PR Newswire, October 13, 2022, https://www.prnewswire.com/news-releases/aflac-dental-vision-and-hearing-plans-now-available-to-individuals-outside-the-traditional-worksite-301648479.html

[2] McGrath, Jenny, “Beam desires to offer you a wise toothbrush, then use the information in your dental insurance coverage,” Digital Traits, August 26, 2015, https://www.digitaltrends.com/dwelling/beam-technologies-introduces-dental-insurance-with-its-smart-toothbrush/

[3] Shashoua, Michael, “Assured Allies companions with EquiTrust on long-term care insurance coverage,” Digital Insurance coverage, December 8, 2022, https://www.dig-in.com/information/assured-allies-equitrust-launch-ltc-wellness-program

[4] Macgregor, Jamie, McCoach, Dan, “Subsequent-Gen Platforms in Group and Voluntary: Exploiting new alternatives throughout the worksite ecosystem,” Celent, August 26, 2021, https://www.majesco.com/white-papers/next-gen-platforms-in-group-and-voluntary/

[5] Collins, Barry, “Apple Will Launch Well being Insurance coverage In 2024, Says Analyst,” Forbes, October 18, 2022, https://www.forbes.com/websites/barrycollins/2022/10/18/apple-will-launch-health-insurance–in-2o24-says-analyst/amp/

[6] Small enterprise worker advantages, ADP, https://www.adp.com/sources/articles-and-insights/articles/s/small-business-employee-benefits.aspx

[ad_2]