[ad_1]

Obtain free US rates of interest updates

We’ll ship you a myFT Every day Digest e mail rounding up the newest US rates of interest information each morning.

The US Federal Reserve will defy traders’ expectations and lift rates of interest by at the very least one other quarter-point, in response to a majority of main tutorial economists polled by the Monetary Instances.

Greater than 40 per cent of these surveyed mentioned they anticipated the Fed to lift charges twice or extra from the present benchmark degree of 5.25-5.5 per cent, a 22-year excessive.

That is in sharp distinction to the temper in monetary markets, the place merchants in federal funds futures consider the US central financial institution’s coverage settings are restrictive sufficient to get inflation underneath management and so it could maintain charges on maintain effectively into 2024.

The survey, carried out in partnership with the Kent A Clark Middle for International Markets on the College of Chicago Sales space Faculty of Enterprise, means that absolutely rooting out value pressures and getting inflation again right down to 2 per cent would require extra prohibitive borrowing prices than market members presently anticipate.

“A number of the indicators that we’re getting are that coverage isn’t that tight,” mentioned Julie Smith, a professor of economics at Lafayette Faculty, noting that interest-rate delicate sectors such because the housing market remained “surprisingly robust” regardless of having taken an earlier hit.

“It doesn’t seem to be there may be sufficient pullback from customers to gradual the financial system, and I believe that’s actually the difficulty.”

Of the 40 respondents polled between September 13 and September 15, about 90 per cent consider the Fed has extra work to do.

Practically half of the economists surveyed forecast the fed funds price would peak at 5.5-5.75 per cent, indicating yet one more quarter-point price rise.

One other 35 per cent anticipate the Fed to maneuver two extra quarter-point notches, pushing the benchmark price to five.75-6 per cent.

A small cohort — 8 per cent — suppose the coverage price will prime 6 per cent.

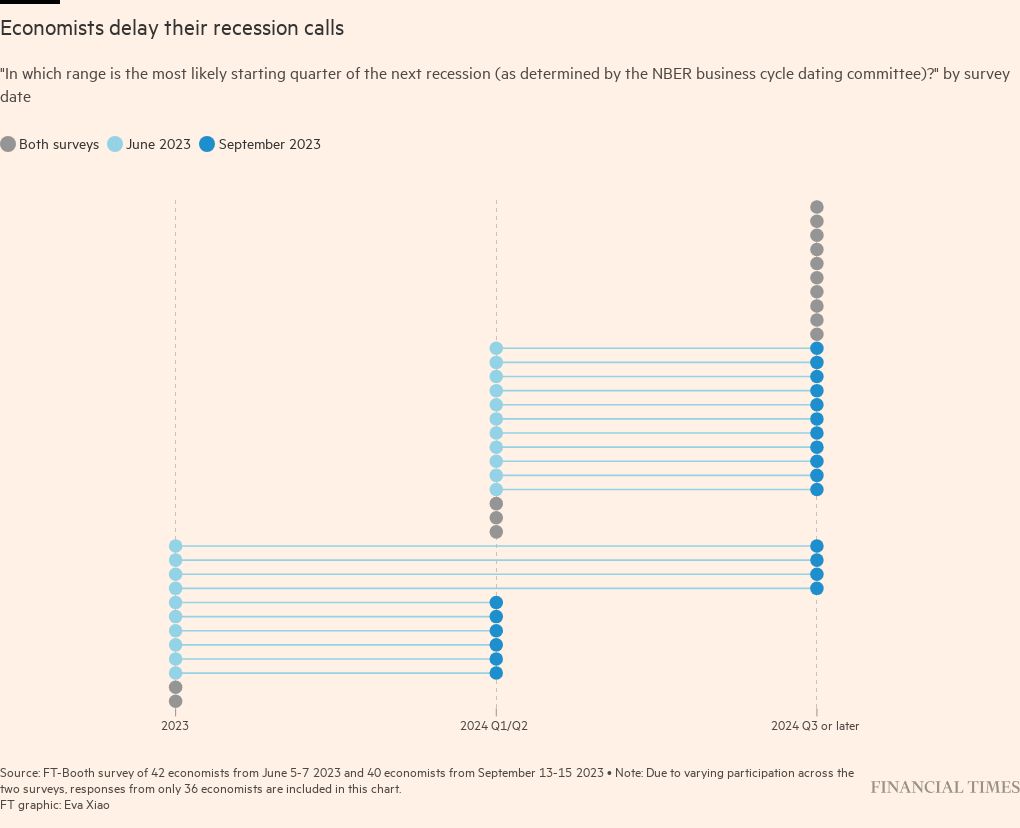

As soon as charges peak, the economists surveyed had been overwhelmingly of the view that the Fed would maintain them there for fairly a while. About 60 per cent of these polled thought the primary lower would come within the third quarter of subsequent yr or later.

That’s almost double the proportion of economists who predicted that timescale in June, the final time they had been polled.

The survey comes simply days earlier than Fed officers are resulting from meet for his or her subsequent coverage assembly, at which they’re anticipated to once more maintain off on additional motion.

The fast coverage tightening since March 2022 has been probably the most aggressive effort to scale back demand in many years.

Whereas inflationary stresss have receded and the labour market is softening, most of the surveyed economists fear that underlying momentum on the earth’s largest financial system continues to be too robust and that inflation will change into more durable to root out.

Gordon Hanson, a professor at Harvard Kennedy Faculty, mentioned: “Similar to there was concern that the Fed was too gradual to react, you don’t need the Fed to be too fast to chill out.”

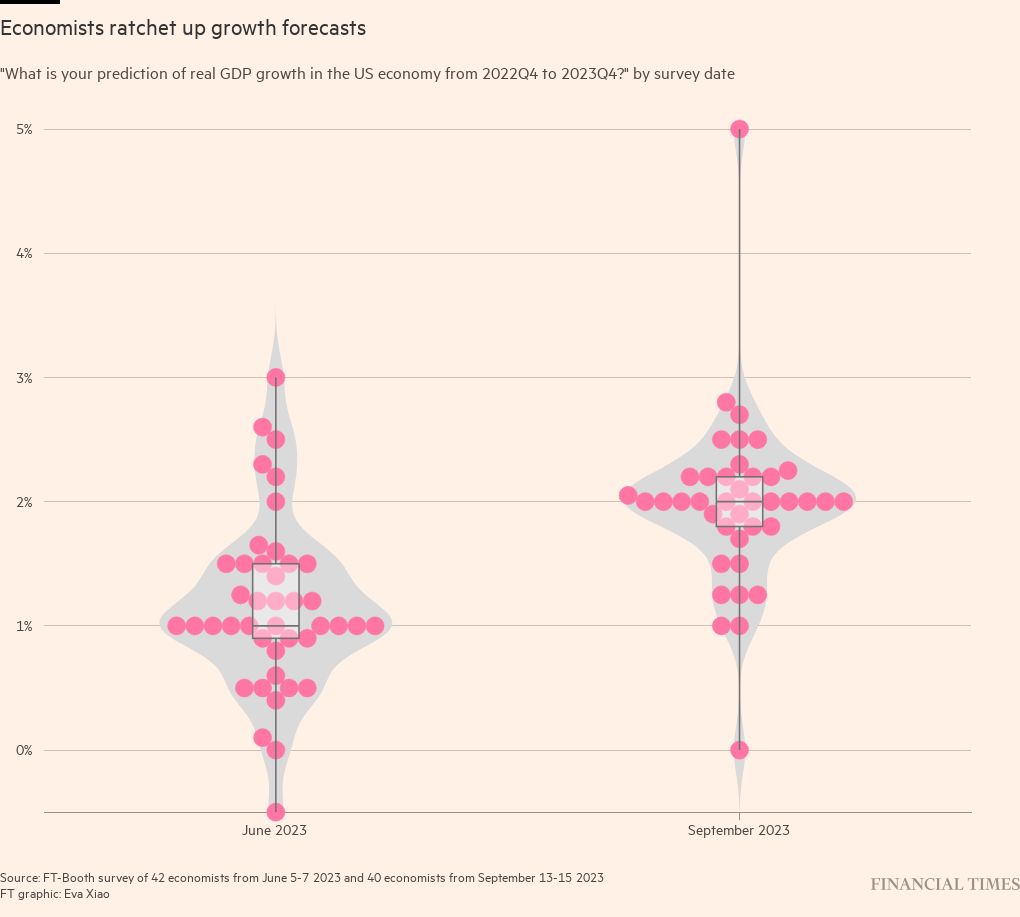

Since June the survey’s respondents have doubled their forecasts for financial progress by year-end, to a median estimate of two per cent.

The unemployment price is projected to settle at 4 per cent, whereas the Fed’s most well-liked inflation gauge — the private consumption expenditures value index as soon as meals and power costs are stripped out — is predicted to average to three.8 per cent. It’s working at 4.2 per cent as of the newest knowledge in July.

By the top of 2024, solely a 3rd deemed it “very” or “considerably” unlikely that core inflation would exceed 3 per cent. The overwhelming majority noticed both even odds or extra that it will.

A curtailment of oil provide is the most important threat to the inflation outlook, they mentioned.

Christiane Baumeister, a professor on the College of Notre-Dame, is amongst these to fret about power costs after the choice by Saudi Arabia and Russia to chop provide. She expects costs to rise additional, probably bidding up expectations of future inflation in addition to delaying the descent in core value progress if firms choose to go on increased prices to customers.

The sharp slowdown in China’s financial system may offset this; it’s set to tug down international progress within the coming months.

Home headwinds, together with the reprisal of pupil mortgage funds and the looming risk of a authorities shutdown, may additional weigh on demand.

Sebnem Kalemli-Özcan, an economist on the College of Maryland and a member of the New York Fed’s financial advisory panel, is among the many majority of economists polled who consider the so-called impartial price of curiosity — a degree that neither stimulates nor suppresses progress — is increased than prior to now in the meanwhile.

It will additional delay how rapidly the Fed will be capable to lower its coverage price subsequent yr, she mentioned.

“Regardless that we’ve a way it’s increased, we don’t know precisely how excessive R-star is true now,” she mentioned.

The economists surveyed have change into extra optimistic in regards to the odds of a delicate touchdown, whereby the Fed can deliver inflation down with out extreme job losses.

Greater than 40 per cent deemed it “considerably” doubtless that bringing inflation again down in direction of 2 per cent might be achieved with out the unemployment price having exceeded 5 per cent. One other quarter of the respondents mentioned it was “about as doubtless as not”.

When requested in regards to the timing of the subsequent recession, many pushed again their estimates additional than they’d beforehand predicted.

[ad_2]