[ad_1]

Obtain free Eurozone rates of interest updates

We’ll ship you a myFT Each day Digest e-mail rounding up the newest Eurozone rates of interest information each morning.

A number of of the European Central Financial institution’s extra hawkish rate-setters imagine rates of interest might rise once more in December if wages preserve rising quickly and inflation proves stickier than hoped.

Traders extensively anticipate the ECB’s price rise on Thursday, which noticed the deposit price hit 4 per cent, to be its final.

However three folks concerned within the financial coverage assembly instructed the Monetary Instances that, if eurozone inflation have been larger than forecast, the door was nonetheless open to elevating charges once more when the central financial institution updates its projections in December.

“I don’t agree that we’re undoubtedly carried out,” stated one of many policymakers. “We would want a really destructive shock [on inflation] to hike once more in October, however we’d in December.” One other one stated a quarter-point rise in December was “nonetheless attainable — I’m not ruling it out”.

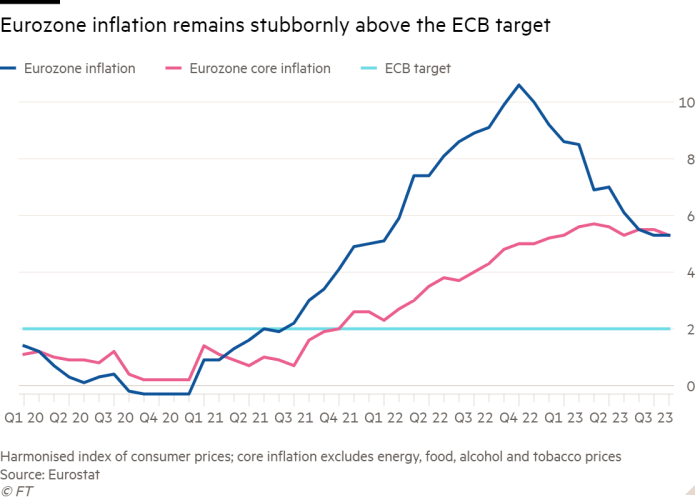

The central financial institution stated on Thursday that maintaining charges at their present degree “for a sufficiently lengthy length” would make “a considerable contribution to the well timed return of inflation” to its 2 per cent goal. That rhetoric fuelled expectations that this was its closing improve, as buyers wager its subsequent transfer could be to chop charges within the first half of subsequent 12 months.

Nevertheless, ECB president Christine Lagarde pushed again in opposition to this after a gathering with eurozone finance ministers in Spain, saying: “We now have not determined, mentioned and even pronounced cuts.” Requested if the ECB had completed elevating charges, she stated: “What I can guarantee you is that we’ll get there. We are going to tame inflation.”

ECB policymakers instructed the FT there was nonetheless excessive uncertainty over how shortly value pressures would subside, particularly as wage development stays excessive in a lot of Europe — a difficulty flagged by ECB chief economist Philip Lane throughout its assembly this week.

Lane highlighted current offers with Dutch unions for employees to obtain pay will increase of not less than 10 per cent. He was instructed concerning the agreements by Dutch central financial institution boss Klaas Knot, the policymakers stated. The ECB and Knot declined to remark.

Knowledge launched by Eurostat on Friday confirmed the eurozone’s hourly labour prices rose 4.5 per cent within the second quarter from a 12 months earlier. The slowdown from will increase of 5.2 per cent within the first quarter and 5.9 per cent within the fourth quarter of 2022 suggests a stabilisation in wage development.

Lagarde stated on Thursday that the contribution of labour prices to eurozone inflation had elevated in the course of the three months to June. Pay per worker within the eurozone rose 5.5 per cent within the second quarter from a 12 months earlier, near a report excessive. This helped to push inflation within the companies sector, the place labour is a big chunk of general prices, to five.5 per cent in August.

“A long-lasting rise in inflation expectations above our goal, or larger than anticipated will increase in wages or revenue margins, might drive inflation larger, together with over the medium time period,” Lagarde stated, including that she couldn’t say that charges have been “at peak”.

However she additionally stated there have been early indicators of firms absorbing larger wage prices by squeezing revenue margins, quite than elevating costs.

The ECB on Thursday elevated its inflation forecasts for this 12 months and subsequent 12 months, primarily on the again of upper power costs, whereas it predicted that shopper value development would solely sluggish to its 2 per cent goal by the top of 2025.

“We’ve had inflation above goal for 2 years and we’re projecting it to remain above goal for one more two years, so we have to see it coming down to focus on in a well timed approach,” stated one participant at this week’s assembly.

The choice to extend borrowing prices for the tenth consecutive time sparked renewed ire in Italy, the place Prime Minister Giorgia Meloni’s authorities has repeatedly protested in opposition to the ECB’s technique to fight inflation.

In a tv interview late on Thursday, deputy prime minister Matteo Salvini slammed the newest transfer as “the umpteenth mess made by the ECB that, with out caring concerning the difficulties of households and companies, raises the price of cash”.

“Lagarde lives on Mars . . . elevating the price of cash is uneconomic, delinquent, anti-historical,” Salvini stated.

Some buyers additionally questioned why the ECB raised charges this week, given the deteriorating outlook for the eurozone financial system, with Germany getting ready to a recession and each retail gross sales and industrial manufacturing falling throughout the bloc in July.

“It was a coverage mistake to hike once more,” stated Martin Wolburg, senior economist at Generali Investments Europe. He stated the ECB’s lowered eurozone development forecasts of 0.7 per cent this 12 months and 1 per cent subsequent 12 months nonetheless appeared “too optimistic” and predicted that officers could be “caught on the unsuitable foot” by an extra slowdown within the financial system later this 12 months.

Ann-Katrin Petersen, senior funding strategist on the BlackRock Funding Institute, stated that after the ECB’s “dovish hike” the main target was “now shifting from how excessive coverage charges get, to how lengthy they keep there”.

The ECB’s unprecedented 4.5 proportion factors of price rises since final 12 months, coupled with a weaker Chinese language financial system and stock destocking at European producers, “makes a recession possible within the coming quarters”, Petersen stated. Nevertheless, she added that this was unlikely to result in price cuts till “properly into 2024”.

[ad_2]